As a non-resident of the USA, you might at one moment be looking for a way to get a USA Virtual Bank Account for your online transactions. This will of course be necessary especially if you are to make purchases of products from the USA where a US Bank account is required.

In this article, we will be telling you the ways to get a USA Virtual Bank Account as a Non-resident without an SSN or ITIN in 2024. That is, you won’t have to go through the hassle of needing a US Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN).

Owing to some restrictions the USA has put in place, non-US residents as well as citizens without a Social security Number) cannot easily open a personal or Business Bank Account.

In such a situation, a virtual bank account will be the best possible solution for you to do business in the USA and receive payments while minimizing additional transaction charges.

What is a virtual bank account?

A virtual bank account is a kind of like an Internet bank account. They usually do not have any physical branches or ATMs and transactions take place over the Internet.

A virtual bank account is identical to a physical account. When you create one, you will as well have a unique account number and can perform the same types of payments as you’d normally do with a physical account.

Advantages of using a virtual Bank account

- Lower transaction fees

- Quickly and easily monitor any transaction or expenses.

- Since it is entirely online, there is usually a very good a fluent customer support

- Flexible and easy to create

- Instant Global payments. This means with just a click you can immediately send money to any country.

Trending on Cryptos:

- Best ways to make money through crypto in 2024

- The Growing Threat of Cryptocurrency Hacks: What You Need to Know

- A Beginner’s Guide to Making Money With Cryptocurrency Trading

- Is it Possible to Distinguish Legitimate GPT Trade Websites from Fake Bots?

- Online Trading Made Easy with Immediate iplex: A Comprehensive Review

Some drawbacks

- Since there is no physical ban location, there is No Personal Relationships between you and the bank and this could prove problematic if you need additional financial services, such as a loan, or when you have to make changes to your banking arrangements.

- Since it relies on internet connection, your ability to access your accounts might be affected in case of any connection disruptions and this could be a big blow to your business.

- Privacy and security concerns

Getting a USA Virtual Bank Account as a Non-resident without an SSN or ITIN

Now, let’s come back to the original goal. Where do you get or how do you create a virtual bank account to do transactions where a USA account is required?.

Below, we have listed some of the best Virtual account providers. With these providers, you will be able to get a USA virtual Bank Account for either free or after spending just a little. Also, there won’t be any need for a Social security number.

[irp]1. Virtual Bank Account with Payoneer.

Payoneer is one of the trusted financial services companies that has been online for a long time. They offer non-US citizens the possibility of creating a US-based account without the need for an SSN.

With Payoneer, you also get the option of getting a virtual Credit card number for your virtual account.

Payoneer Virtual bank account allows you also to withdraw money to your local bank account.

Getting a Payoneer virtual bank account

- Start by creating a Payoneer account.

- Next, request a free USD debit MasterCard.

- Now, once you get your virtual MasterCard, you will have to activate and link it to you account. After this, Payoneer will send you an email to apply for the Payoneer US bank account service where you can apply for a virtual US bank account.

- You will have to reply to the email and provide them with a valuable idea that will guarantee your eligibility of getting a virtual bank account. This is why it is best suited for those who have a good business profile online.

- Once your application is approved, you will get your free virtual USA Bank account with a virtual MasterCard to use for your online transactions.

Recommended for you

- Why OTP Isn’t the Best Security Measure Against Hackers

- ChatGPT now has the option to turn off your chat history!

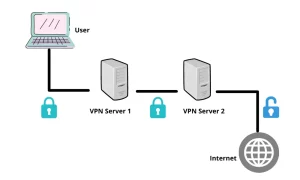

- Which VPN to use for ChatGPT? Here are some of the best VPNs for ChatGPT

- Here is how to use ChatGPT on WhatsApp

- Elon Musk is preparing his own AI company to outcompete OpenAI

2. Community Federal Savings Bank (CFSB)

Another good alternative way of getting yourself a legit USA Virtual Bank Account is via Community Federal Savings Bank (CFSB).

CFSB Bank is one of the first global virtual banking services, which, in fact, was created as a mobile application from an organization that is not a bank but promotes its services like banking, relying on legal and processing support Partner bank.

Community Federal Savings Bank is an FDIC-insured bank that is privately owned by veterans. Its emphasis is on mortgage lending, but the bank also offers deposit products that earn interest.

Promoted contents:

This virtual bank offers you the possibility of creating either a Personal account or a Business account.

With their business account, you will enjoy the following:

- Obtain balances on deposit accounts.

- View “real-time” current day account transactions.

- View images of checks cleared and deposits.

- Review the transaction history on Internet-enabled accounts.

- Transfer funds between accounts.

- Pay bills using bill payment and presentment services.

- Place stop payments.

- Initiate wire transfers.

And if you choose to go for a personal account, then note that it has these key features:

- Check Imaging

- Online Statements

- Check Reorder

- Bill Payment

Creating your account

- Head to the CFSB Website and choose the sign in option based on the type of account you want to create.

- Fill out the application form provided and wait for your account details to be issued.

3. Paxum

Paxum gives you the possibility of getting a USA Virtual bank account with Automated Clearing House payment transaction (ACH) capability. The ACH is the primary system that agencies use for electronic funds transfer (EFT). With ACH, funds are electronically deposited in financial institutions, and payments are made online.

This Bank offers their business clients a USA and EU Virtual Bank Account as part of their services but No SWIFT, only local ACH or SEPA payments. Paxum also has support for different currencies.

[irp]For those who work with USA-based companies that can only pay to USA-based bank accounts, this will be a good choice to go in for.

With Paxum, you can create either a personal or business account. And with PAXUM BANK dedicated ACH account, no matter where you are located, you will be assigned a dedicated US Virtual account at a major US bank with your name on the beneficiary field.

Once you register for an account, you will have to submit your documents for Identity verification before you can get a working Virtual Bank account plus a virtual prepaid card.

4. Get a USA Virtual Bank Account with Wise Borderless

Wise Borderless, previously TransferWise Borderless is another good virtual bank account provider that will suit your need for a US-based bank for your online transactions.

This account type offered by Wise is for businesses and freelancers who have international customers.

Wise offers you the option to have an American virtual account alongside a European virtual bank account. And you get a sort routing number, account number, SWIFT / BIC, and IBAN codes that you can use to easily make and accept payments in local currency.

Wise has both an Android and iOS App you can use to manage your account and transactions.

5. Other good USA Virtual bank account providers

- Paydek

- Revolut

- Payssera

- GetBizToUSA

Our say

Traditional banks still have their words to say and offer services that most Virtual Banks can’t afford to offer you. But if you do business online and deal with US-based companies, your local Bank might prove useless. In such situations, you will want a flexible bank that can allow you easily do your transactions with ease while you easily monitor the transactions.

Virtual Banks are pretty easy to create and will usually offer lower charges when you shop online with.